CAN ONE AVOID SADNESS?

From an email I reeived: “I have an incredible sadness that often can be quite overwhelming in my life. Does that ever go away? I’m really scared it won’t. I’m not depressed, because generally I’m happy enough- its when the emotions are just overwhelming, the loneliness etc blah blah blah- the usual things that break us all apart.

So, does it go away?”

Answer:

I am sorry you are feeling sadness. I will tell you something. At one point i was addicted to an anti-anxiety drug. I was undergoing a lot of stress. But after awhile (2 years) I didn’t have the stress anymore. But I was now addicted to this drug. The drug was no longer helping me. But when I would try to get off the drug bad things would happen. I would survive maybe 2 or 3 days and then I would feel an incredible sadness that was out of my control. I would barely be able to function and the slightest thing would make me cry.

It’s not just because I was getting off the drug. It’s because, if you look for it, the world gives us plenty of opportunities to be sad. The world is a sad place. And if we fool ourselves into believing otherwise, Buddha is there to remind us with his rule #1: the world is full of suffering and there is no way to avoid it. At first I tried to avoid it with the anti-anxiety drug. But when I wasn’t anxious anymore and I wasn’t sad and I tried to get off the drug, I would notice everything in the world that was still sad. Still a cause of misery, the scent of death, the sulfuric taste of despair. I couldn’t shake it off my five senses. And I would sit in my livingroom and cry and think of other people who were sad and think of the beautiful hopelessness of everything.

There are solutions then. Not to get out of it, because the suffering is always there. But to understand its purpose. By sitting with it’s purpose, understanding it, assimilating it RIGHT NOW instead of disappearing into the past or the fearful future, one learns to live with it, to even rejoice in it.

The first solution is to talk to someone. Why are you feeling sad? Is there a reason. Talk to someone you trust. Talk to someone you are sincerely grateful they are in your life. Whether it’s a therapist, a friend, someone you love. Someone you barely know.

The second, of course, is medication. If there’s no reason to feel sad then perhaps some chemicals need to be put back in place, although hopefully in a non-addictive way.

The third is exercise, eating well, no alcohol, sleeping well, and meditation or yoga. All of which act as anti-depressants. As does socializing with friends, painting, being creative, etc. [See, 10 Unusual Ways to Release Oxytocin In Your Life]

The fourth is a trick. I do this trick because it’s what I personally believe. The universe is like a curious old man. It doesn’t know many things. Infinite things. We can’t even fathom what it knows and what it doesn’t know. it doesn’t know, for instance, the experience of “I am feeling sad”. So it takes a piece of itself and makes you, just like it makes me, just like it makes animals, and our neighbors, and our friends. We are bits and pieces the universe has breathed life into for but a moment in time. It wants to learn from us. It wants to learn what “James is feeling sad” is like so then it knows forever. And then in the blink of an eye, because that’s how long we live in the eyes of the universe, you and I and everyone we know are back in its pulsating heart, part of the universe once again, not even remembering that we ever left it.

But it’s learned one thing. The feeling of me feeling sad. That moment, that sadness, this moment right now with you reading my email: its not you learning, its the universe learning. Me typing this email is the universe learning. When I sleep tonight, the universe will dream. When I feel sad over a fight my daughter has with her friend, the universe will grieve but then rejoice because it’s learning so much. Then I can rejoice because every pain, every sadness, every moment, is ME, the universe manifest, learning something new. What a great thing that is!

At the end of all this is nothing but rejoicing. We are giving and giving because the universe takes it all in and then we return home to it. In fact, we never left it. We only did a little dance, so the universe can learn the steps.

All of these things will work. And none of them will work. Because at the end, we are part of a much bigger picture. And that picture has no boundary, no edge, the paint drips out of us, runs over the edge, and spills out into all of life.

For me, this is what I believe.

MY WIFE CHEATED. WHAT DO I DO?

From an email: “My wife cheated. I played detective, saw the phone bills, followed her, found out. She confessed and said it wouldn’t happen again but I can’t get over it. What do I do?”

Answer:

Many years ago a girl I was going out with got pregnant. She was devastated. She wouldn’t return my calls and finally I went over her house. She wouldn’t let me in the house. We took a walk and she was crying and she told me she was pregnant. I thought I was in love with her. I would’ve had the baby. I would’ve done anything for her. When we were sitting down on a park bench she was crying. I kept asking her what was wrong. People were looking over at us like I was about to hit this crying girl and maybe they needed to jump into the action.

She told me she didn’t know who the father was. She went over the times and it could’ve been this other guy. She had cheated on me when I had been on a trip.

My entire world turned upside down. I didn’t know who she was. Who I was. I felt like I had been played for a fool. I had been played for a fool. I was such a fool. To be chasing her. And I suddenly went over every night where she might’ve been out. When I was busy doing something. When I didn’t stay over. Every moment, every second of every day. The time I saw her walking around the block. The time I ran into her on the other side of town. So many missing jigsaw pieces. Again and again. She was pregnant but I needed to go over the details again and again. I told her not to do anything. I told her. to. do. nothing.

Slow it down. I just needed to process what was going on.

She disappeared for a week. And when she next called me she told me she had had an abortion. She was crying. “Please see me.” And she wanted to get back together.

And you know what? We did. We went out for another six months. And every day I wanted to know where she was in all the minutes she wasn’t with me. Every dayI wanted answers. I wanted to know why, how, who, what. I wanted to spy on her. I did spy on her. I wanted to go out with other women to get back at her. I wanted to kill myself sometimes. I felt so miserable.

And finally SHE couldn’t take it. She broke up with me.

A few months ago I went to a meeting at a new hotel in NY. Some guys were raising money for a movie. I was curious about it. I met them. I walk in there and for the first time in years I saw. Her. Serving coffee. I felt like I recognized her but I couldn’t quite place her and I started walking over while smiling. She saw me and turned red and then smiled back. I realize who it was and I panicked. I just turned around and walked outside. I stood outside for ten minutes. It must”ve been the end of her shift because a few minutes later I saw her leave the hotel with her coat on.

When I went back into the meeting I told these guys, who I had never met before, what had just happened. The coincidence.

One of them said, “you’re lucky you got out of that mess.”

And yet, I never did. You never get out of the mess. The trauma of betrayal is stamped on you forever. Not only that, the betrayal would never have occurred if I had not been a jerk in many ways. If I had not been so inattentive. If I had not made my own crazy maze that I got lost inside of. It always takes two to create a betrayal.

But now you have to look at that betrayal, and yours, in the face of every new relationship you have. It’s like a discerning and critical grandmother who sits on your shoulder and has to approve every new relationship. No more games, I thought to myself, with any new relationship. And yet I still got into games. Many games. Too many games. Until finally the games were over. The games had frayed me to the bone. Could I have somehow made it work. Or made any of the relationships in between work? Maybe. Who knows.

I don’t know why I tell you this. Except to say right now I’m the happiest I’ve ever been.

WHAT IS THE BEST WAY TO ACHIEVE SUCCESS AS AN ENTREPRENEUR?

Serena Blasing @SerenaBlasing: what is your biggest advice in obtaining success as an entrepreneur?

Answer: There is no such thing as success as an entrepreneur.

If you ask ten different people what success means you might get ten different answers. Financial freedom, paying down debts, building a big company, personal freedom, etc and there might be psychological goals as well: proving everyone wrong, proving my parents wrong, proving that I can make the impossible possible, and so on. Many rich people become entrepreneurs even though they have financial freedom already. Many poor people become “lifestyle entrepreneurs” – they never get rich from their business but their business sustains their lifestyle.

But one thing is in common with anyone who truly is a successful entrepreneur: they set out to create a solution that would make people’s lives easier.

If you always have the affirmation in your mind, “I need to give to receive“, and force all of your thoughts to coalesce around that affirmation, then over time and experience you will create a product or service that will make people’s lives easier or better or wealthier. This is a service that people will pay you more than cost for.

I’ve been involved in many successful businesses. I’ve also been involved in many unsuccessful businesses.

I’ve written about many of them here. For instance, I thought I had a great idea once: 140love.com. I created a dating site on top of twitter. I thought it was brilliant and I even had investors. What could be better: a dating site (which is a universally accepted successful business model – bringing two people together so they can kiss, have sex, have great pleasure, get married, have kids, prolong the human race, etc) combined with twitter, the fastest growing social network at the time. I was single then and heavily using both dating services and twitter. Plus twitter was “cool” in the tech community and I wanted to be cool.

The idea would be that people can’t fake it on twitter. My service would match you with people similar to you and then you could judge whether or not you want to go out with them by their tweet feed. No bullshit profiles. You’d see the real them with their tweets.

Here’s the problem. The very basic problem. On dating sites people like to be largely anonymous. On twitter, people weren’t anonymous. So I wasn’t helping anyone. If anything, I’d hurt anyone who signed up for 140love. Failure. I spent $40,000 developing it.

Here’s another failure: Junglesmash.com. I wrote about it here but I’ll describe really quickly. I wanted to crowdsource advertising. Typically a big brand hires an ad agency and pays them millions of dollars to create and then spread an ad campaign. I love a good ad.

So I set up a site, I picked a random brand (Crest) and offered $2000 to anyone who made an ad that I liked. Hundreds of people submitted ads. PROCTER & GAMBLE EVEN SUBMITTED ADS. I knew this was going to be a success because:

A) I was helping people make money

B) I was helping people have an outlet for their creativity where they can make money

C) I was reducing the costs of creating an ad campaign by the major brands. I always think when you take out the middleman that’s a valuable service you can offer as an entrepreneur.

D) I was reducing the costs of distribution since the good ad campaigns could conceivably grow viral and create brand awareness

E) Finally, I was getting results. Both people and brands were responding.

So why did this fail? Because I personally failed. It’s still a good idea. But precisely those months I was going through a separation, moving houses, I was trying to start a fund that was failing, the financial crisis was scaring me, and I was slipping through the rabbit hole leading me into depression, despair, and a black hole of desperation that would take me awhile to get out of. When I came out the other side I was better for it, but I no longer was doing it.

Other businesses I was involved in that I consider successful:

– Reset, Inc. – Back in 1995, very few companies had a website. My only competitors were companies like Razorfish that would charge a million dollars for a 5 page website. I was able to compete on price and quality and grew my business until I sold it.

– Stockpickr – a financial site that was pure stock ideas. No news. In order to pick stocks you have to avoid the news. I’ve been involved in the management of several public companies. What you see on the inside is a lot different from what you see on the outside. It’s like a black hole. Nobody knows what really goes on inside a black hole because information would have to escape the gravitational pull at faster than the speed of light. Same thing with a public company. So I created the one website that had ten different ways to come up with stock ideas, combined it with community, and did away with all news. The result was millions of unique visitors per month plus good advertisers like Fidelity.

– a mental health facility – The mental health space is very regulated. And it’s all about filling beds. This particular facility treated teenage addicts. They had a way of getting through all the regulations. They also had a way of quickly expanding their number of beds by buying cheap hotels and converting them. There were no other facilities in their state so they had a monopoly. So once again, helping people in ways that the people could not otherwise be helped. The business sold for a huge multiple of earnings.

There are others but when I look back on the ones that were successful versus the good ideas I described above that was unsuccessful I can think of two common denominators:

A) Help others. You have to really make sure you’re not just coming up with a “cool” idea but that you are actually solving a problem that many people have.

B) Persistence. In every business I probably thought I was going out of business over a hundred times. Or my investment (in cases like Buddy Media) was going to zero many times. You have to constantly problem solve and not judge yourself so harshly on your bad decisions that you give up. I’ll have another post on persistence. But at the very least have this checklist before you start a business.

If you have just these two things then success will be achieved, whether or not it matches your definition of success.

WHAT WILL BE THE SOCIAL NETWORK OF 2020?

Ajay Awatramani @Jarmoney: What would the popular social network of 2020 look like?

Answer

A little website that a few people have heard of.

Facebook.

Everyone seems to assume Facebook is a fad. Here’s some things I hear: “Facebook is the next MySpace”. Or, “Mark Zuckerberg is a bad CEO”.

Really?

Facebook has a billion users. MySpace peaked around 100 million. Facebook is in every country on the planet. More time is spent on Facebook than any other site by a factor of about 100. Let’s see. What else is Facebook? It’s the world’s largest dating site. It’s the world’s largest photo sharing site. It’s the world’s largest gaming site. I use it every day. My 13 year now uses it every day. My wife uses it every day. I think everyone I know uses it EVERY DAY.

What will happen between now and 2020? Facebook will get better. Two ways Facebook will get better:

Location:

So that means more interesting things will happen between Facebook and my phone. Depending on privacy settings maybe I will be walking in NYC and I will get an SMS: “you just passed John Smith sitting in the Starbucks. If you go in and join him you get 10% off our coffee.”

Content:

What else can get better? I don’t mind ads that target me very accurately. The more accurate the targeting, the more likely it is that ads become actual content. For instance, based on my Facebook interests plus my Amazon purchase history I wouldn’t mind if every day Amazon recommended a book for me to buy. Or, if most of my friends are in LA and I’m in NYC I wouldn’t mind if Expedia offered me discounts to get to LA.

As for Mark Zuckerberg:

– in the past 6 years he’s built up a site with a billion users

– he’s built up a company with a few billion in revenues.

– he just had an IPO raising $12 billion with the lowest possible dilution, with the lowest fees to Wall Street for any IPO ever at that level. Short term flippers were screwed but long-term shareholders will benefit.

– he’s responded to every privacy issue, every complaint, to keep building a brand that people trust.

– he’s “organized” the Internet by developing a common format for individuals and companies to share information. That’s why more and more companies are making their company URLs be their Facebook URLs. That’s why the notion of “your home page” has now been replaced by “your Facebook page”.

Let him stick around a little more. I’m sure he’s got some good stuff planned for us between now and 2020. And congrats to him for donating $100 million to Newark’s school system.

WHERE TO INVEST

Nick @NotthatkindofDr: As a 28 y/o graduate student, given the neg real return in savings accounts, what areas would u suggest investing in?

Answer: only invest in yourself. there is nothing else that will get u more than 5% per year.

When I first made some money I would wake up in the middle of the night scared. What if Y2K caused the world to end? I had lunch one day with the head of IT at a big Fortune 500 company. He said all his computers were going to shut down on January 1, 2000. , What would happen to my money. I would take long walks at four in the morning calculating out how I can save my money in Y2K. I would compound things 20 years ahead to make sure I could pay for my then (one) kid, my family, myself. Would I be able to retire? I would stand in the shower and wonder: what if I gave my parents half my money? Would they be able to survive?

I had $15 million in cash at the time. About year or so later I had $0.

All of that time in the shower, compounding interest, worrying about Y2K or war or inflation led to… $0. At $15 million I honestly thought I was poor. That somehow inflation would outpace me. That people would be making salaries of $10 million a year. Or that every entrepreneur would be richer than me. That I wouldn’t be able to afford the lifestyle I wanted. That my kids’ kids would go broke. That I hadn’t prepared adequately for various scenarios that would bring down the financial system. So I thrashed and invested and re-invested and doubled-down and spent, all in a desperate quest to turn my mortality into immortality. There were moments when I thought I was immortal, that money had somehow acquired for that elusive elixir of youth and vitality. I was 32 years old. Just a baby. Just a little older than you are now.

Then I had nothing. I missed the one thing that was most important. I forgot to invest in myself. This means lots of things.

– invest in your health. This has nothing to do with money. Are you eating ok? Are you sleeping well? Are you flossing? Dental infections can go from the mouth to the heart to the brain. There’s some evidence that lack of flossing is directly correlated to early onset of Alzheimer’s. Are you exercising? Are you breathing ok?

– invest in your friends. When I had money, I dropped my friends. I took on new friends. Everyone spoke about money all the time. Alex would point out a billionaire at a Las Vegas craps table who was surrounded by prostitutes and say, “that guy is a stud”. People who didn’t make it in that world were “losers” or “fuck ups”. Nobody read. Nobody talked about anything but money. Everything had a price tag. Everyone would put you down because of secret jealousy. And, of course, nobody kept in touch with me after I lose all my money.

– invest in your ideas. Are you still coming up with ideas like you once did? I used to come up with ideas for my business every day. New clients, new business directions, new ideas for the clients, new ideas for employees, new ideas for how we could get investors or acquirors. New ideas how to do things cheaply. Once I sold the business I stopped having ideas. My idea muscle atrophied. I was an immature little kid with a room filled with toys. All I wanted to do was play. It wasn’t until after I lost everything and lived through a year of excruciating depression that I pulled out a waiter’s pad and started coming up with ideas again. And then it was another several years before I finally climbed out of a total financial nightmare.

– invest in your spirit. Two ways: Are you grateful for what you have. Don’t always think about investing in the future. Be grateful for everything you have right now. Every day list the things you are grateful for. The second way: surrender. You can’t control everything. I should say, “I can’t control everything”. I can’t control what will happen with the world, with the economy, with the factors of luck that helped me make the money. Surrender to whatever mystery is inside of yourself that helped you get to this point. You can say, “there is no mystery”. But there is. It doesn’t matter if you are a scientist, a religious person, a spiritual person, or an entrepreneur, there’s mystery in everything you touch. What happened before the Big Bang? What exists in the space between a proton and an electron inside the atom? What combination of molecules inside of us created the consciousness that allowed you to make money. Bow down to the mystery and trust it.

When you do the above four things your body, mind, emotions, spirit, will tap into the pulses and vibrations of everything around you. Your mind will be an idea machine. Your spirit will be free from the worries of the future and anxieties of the past. Your emotions won’t be sidetracked by the negative people who try to bring you down. And your body will have the energy to pursue any idea to its fullest. You’ll also know the most important thing: when nothing is the right thing to do. Sometimes the best investment is waiting. Is decreasing. Is slowing down. Is observing.

When I was just starting my first business I met with Jason Calacanis. He was starting his first business, the Silicon Alley Reporter. I loved his magazine. It reported on all the web agencies in the so-called “Silicon Alley”. In other words, all my friends that worked in a 10 block radius of where I worked. I was an advertiser in the magazine. At the time, Joanne Wilson (Fred Wilson’s wife) was the head of advertising for his magazine.

Jason and I met for coffee. He was reeling off fact after fact about every Internet business out there. There barely was an Internet industry and he knew the entire universe of it. I said to him, “why are you doing this magazine? You should be working for a top venture capitalist. You can help invest in all of these companies.”

He said, “I only want to invest in myself. That’s where the best returns will be.” Silicon Alley Reporter didn’t quite work out. But his next business, weblogs, inc. he sold to AOL for about $20 million and his latest business, Maholo, raised money at a $100 million valuation. It’s hard to get returns like that investing in anything other than yourself.

And it’s not just money. When I was burnt out and really needed a break from everything I thought I was “supposed” to be doing I decided to start writing this blog. There was zero investment in dollars. If anything, it kept me from foolishly investing in a volatile stock market. It slowed me down. It forced me to think. To write. To relate to people. To communicate with people. To make new friends. To open up new possibilities for myself.

I’ve made many investments that have made me a lot of money. Writing on this blog has made me zero money.

It’s the best investment I’ve ever made.

LIFE AFTER RETIREMENT

Efrain Martinez @martefrain_: it seems like ever since ur born lifes all about working getting promotion etc But whats life after retirement? It seems lifeless

Answer

I was retired when I was three years old. All I had to do all day was shit in my pants and play with my friends, often at the same time. My friends were disgusted with me when that happened and my mother had to comfort me. Other things I remember about my “retirement”: whenever the full moon was out it meant the Bat Signal was ON. Sesame Street had some good moments. I always wanted to try spinach because Popeye ate spinach but I HATED the taste. A special treat in my retirement was when my mom would play JUST ONE MORE game of checkers with me.

On other days I would play with my friends. One time I accidentally broke the door of one friend’s house. Another time I drew all over a friend’s window. Both instances I denied to my parents when their parents inevitably called mine to punish me. Retirement was great. It was creative. I was master of my universe.

And then it all ended. One day I woke up and I was told I had to go to something called “nursery school”. When is it over? I wanted to know. I wanted my retirement back.

My dad explained it to me:

Well first you go to nursery school for two years, then kindergarten, then 12 years of school, then 4 years of college, then probably another 4 years of graduate school, then you work for 40 years, then when you are as old as grandpa, you’ll be retired and you can do whatever you want.

WHAT!!!!

Oh god. And then I went to school and everyone hated me (that thing about shitting in your pants while lying on top of a group of kids just didn’t work very well in a social environment). And then in grade school it didn’t work (peeing in your pants doesn’t work either). And then college didn’t work (homework? tests? a girlfriend who was throwing food at me whenever she got angry, which was every day, and grad school didn’t work (I got thrown out)). Then jobs didn’t work. I was always trying to do something on the side (write a novel, start a business). I wasn’t very good at corporate politics. Later, when I had more flexible jobs I would disappear for months at a time (CEO to me: “Jim Cramer wants to know why you are never here”) or I would just disappear completely (in the middle of a meeting, walking out of the building, never coming back).

“Work” is just a tiny subset of the life around you. You do it to live. You do it when you have to. All other times it should be avoided. You’re in the Matrix but you don’t realize it. Bit by bit you can plan your escape.

“But what if I have no money?” you might say. Good question. EVERYONE has skills to develop multiple streams of income on their own. Make sure you are healthy. Make sure you are coming up with ideas nonstop and your idea muscle is healthy. Be around supportive people. Give yourself a five year time period to break free. And then start dipping your feet in the River of Change. Once you are immersed from toe to head, you will feel as if you are suffocating for air. But you will find an ocean of life swimming around you. You’ll swim off the island, into the current, and sometimes those currents will be rough, will throw you around, will make you feel like you are going to die, crashing into the rocks. But you will never swim back to that little island. The entire world needs to be explored.

That is your “retirement”. It can start right now and it will never be boring and it will never end.

GENERATING IDEAS EVERY DAY

Rich Collins @richcollins: When you generate ideas everyday, do you stick to a particular area (i.e. your current projects) or are you all over the map?

Answer:

Yes, go all over the map. The key is not generating the right idea. The key is that you are making your brain sweat.

If someone told me, “Come up with 100 things Congress can do to make the country better” it will be hard for me. My brain will hurt. Maybe I can come up with 10 really quickly (privatize and sell off all highways and schools. Flat tax of 10%, etc) but maybe around 20 or 30 my brain will start to hurt. Just like my arms would hurt if someone kept adding weights to a bench press. But keep pushing. As they say in the gym, “push through the pain”. It’s only your mind in the way. Get your mind used to sweating past that hard moment where you hit your personal idea frontier.

You want to expand out that frontier. It doesn’t matter how. Come up with ideas for books, for businesses, for art projects, for your friends’ businesses, for recipes you’ve never thought of trying, for movie sequels, for whatever you want. It’s your head! Put the whatever the hell you want in there.

For the first six month it will be like any learning curve. Your idea muscle has atrophied. So for six months it will get better super fast, the way you would increase your golf skills every day if you are a total beginner and start playing every day with a pro. Then at six months it will be harder but that’s ok. You’re already on your way to being an idea machine.

Once you are an idea machine, then you can say: “I want to come up with an idea for a new business” and your brain will work magic for you. It will be like pulling ten beautiful rabbits out of a magic hat. And all the rabbits will live and flourish. You just have to decide which one you will want to keep as a pet and which ones you will give away. You will be so full of ideas you can give and give and it won’t matter. People can steal your ideas, people can give you no credit, your ideas can end up bouncing across the waves and end up marooned somewhere where you can’t touch them. But it doesn’t matter. You will always have more.

And not just in business. In everything. Your car stuck in the middle of the desert? No problem. You will know what to do. Your kids don’t know what to do for their vacations? No problem, you’ll figure it out. Your date treating you like crap. No worries – you’ll dump her/him and quickly find the next one.

Ideas are the way we navigate the zombieland that most people live in. Suddenly you’ll realize they are all moving in slow motion. And you’ll find the path to safety, the path to riches, the path to your home.

ADVICE FOR 24 Y/O ENTREPRENEUR

Bumper Pickner @BumperPickner: Whats the best advice for a 24yr old entrepreneur?

Answer:

There’s only one advice: persistence.

How to be persistent:

– Know that failure happens every day. In small ways and in big ways. I would hire the wrong person (small way), I would start the wrong business (big way), I’d make the wrong investment (medium way, depending on size of investment). But failure happens every day. If 50% of your decisions work out then you are doing ok.

– Don’t smoke crack. When I started my wireless software business I thought immediately it was a big Fortune 500 company that would go public and make billions. When someone wanted to negotiate valuation down I was like, “are you crazy?! We are worth ten times that!” Someone once offered to buy the company for $70 million. NO WAY! I was smoking my own crack. I’ve seen a lot of crack smokers since then. I can always tell a crack smoker. They say their name of their company and it’s like they are saying “Coca-Cola” a brand that has existed forever that will never go away. Always double-check that you aren’t smoking crack.

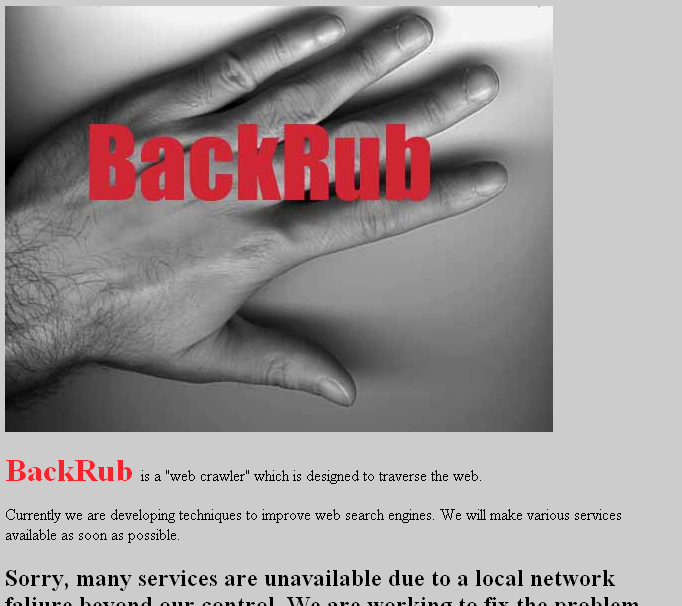

– Don’t become attached to one idea. You’re 24. Let’s look at similar 24 year olds. Larry Page and Sergey Bring came up with their little tweak on search algorithms and they called it first “Backrub” and then “Google”. They spelled “Googol wrong. Perhaps on purpose. In any case, they really wanted to be academics. So they tried to sell their business to Yahoo. Guess what they asked. ONE MILLION DOLLARS! And Yahoo said, “no”.

(see also, “10 Unusual Things I Didn’t Know About Google“)

They were probably dreaming of what they would do with $500,000 each. History proved Yahoo wrong. But guess what. That was the ONLY time basically that a situation like that worked out for the entrepreneur. Take the money and run. When you are 24 don’t get religious about any idea. If someone offers you money that increases your odds of financial stability, you take it. You’ll be an entrepreneur for the rest of your life. You’ll make a lot of money no matter what. But always TAKE money that is offered you.

– Don’t die in the details. In other words: don’t try to patent your idea. Don’t get bogged down in legal agreements. Don’t get bogged down with accountants. Focus on only one thing: building a product that someone wants, and then getting someone to pay you for it. If nobody will pay you for it, tweak your idea until someone does, or bundle your product as a service that you offer that someone will you for. Ask potential customers for advice on what they will pay for. Keep repeating this until someone pays you. Then worry about the details, as your business is growing.

– The buck stops with you. In the beginning you have all of these roles: CEO, director of product development, head of marketing, head of sales, head of customer service, head of investor relations. Don’t give those roles to anyone else unless you absolutely trust them. Don’t delegate before you have something to delegate.

– Keep adding ideas. You have a product. Great. Now add a new feature. Done? Add a new one. Done? Ok, add another. And keep going. I wish in my first business I had done that. I made money but not as much as I think I could’ve.

– Try not to raise money. Of course, at 24, you don’t have money. But see how far you can go without money. If your product can start off as a service, then your customers will pay your bills. Eventually you build up and rent a small space. eventually you build from there and hire an intern. And so on. You can raise money when people are begging to give you money. That’s the best time to raise money. When it’s easy. And then always raise when it’s easy. Because you don’t want to be stuck when it’s hard.

– Give up fast. If an idea is not working, move on. The best way to push a boat is to let the current push it. You always want to go with the current. You’ll feel when things are easy and you are going with the flow. Don’t force it. If you are forcing it then eventually you’ll end up where you started.

– Learn from mistakes. You failed? You made a bad decisions? Learn, analyze, study, write it down, figure it out. You won’t make the same mistake twice. Also, be ready to blame yourself. Don’t blame others. If your business failed then then only fault is with you. Not y0ur partners (pick better partners next time – your fault) and not your clients (pick better clients). It’s ALWAYS your fault when you fail.

STARTUP AND ATTENTION

Anuj Adhiya @AnujAdhiya: What kind of startup would get your attention – enough for you to talk about it?

Answer: a startup that wld get my attention is one that i would use every day.

With startups most people focus on the idea. Everybody wants the biggest, baddest, best new new thing. The thing that will beat Google combined with Apple combined with Facebook.

It ain’t gonna happen. Or, at the very least, if someone had that idea they are not going to show it to me. They are going to show it to Peter Thiel. And with his secret Illuminati of Paypal mafia he’s going to invest $200,000 and make $5 billion on it while I sit out here in the cold trying to figure out why I’m not one of the cool guys who got into Facebook and Twitter in the seed round.

I’m no good, by myself, at investing in startups. One time I invested in a startup with profits, with low capital expenditures, with growing revenues, and I did it all by myself because I thought I have to grab all this for me. I invested a big amount. Then the company somehow went out of business or the CEO stole the money or whatever. I don’t know. It was part of how I went broke.

So now I have a checklist of when to invest. Whenever I follow this checklist, I make a lot of money. Whenever I don’t follow this checklist, I lose money. It’s like clockwork.

A) The CEO has to have built and sold a similar business before. This would’ve kept me out of Google, Apple, Microsoft, Yahoo, and Facebook (but not Twitter, Intel, or Broadcast.com). I basically have no way to judge a product. It may be good or it may not be. But if the CEO has done it before then I can check the box. It doesn’t have to be the exact same product (Buddy Media is an example where I invested and Lazerow had started two prior businesses but none exactly related to Facebook although I would say similar) but the CEO needs to be smarter than me in the area he’s starting his business.

B) I need to have good co-investors. I’m an investor in Israeli startup CTera, for instance, where Benchmark Capital and Venrock are my co-investors. They are smarter than me and they have a team of bloodhounds who did due diligence. In addition, I called the heads of sales in every country. I called customers. I did background checks, etc. So my due diligence combined with the due diligence of people smarter than me was enough to keep me happy. For Buddy Media, Peter Thiel was among the co-investors. BAM!

C) Demographics have to be on my side. I’ll use Buddy Media again as an example. This was in 2007 when I invested. A month earlier I had gone on CNBC saying that I thought Facebook would eventually be worth $100 billion. At the time I don’t even know if it was valued at one billion but I had a strong feeling about the demographic trend. How come? Because I was using it every day and more and more people I knew from every walk of my life were using it, regardless of their backgrounds. So this was happening. I’m invested in another company right now (IPO expected within the next month) that does personalized cancer diagnostics. 75 million baby boomers are aging. A lot of them will get cancer. They all want to live forever. BOOM! Huge market.

D) I have to get a deal. The valuation has to be better than any comparable investment out there. Somehow I have to be getting a discount to where I think the value is in my head. It has to be a discount to RIGHT NOW valuations. Not to where I think the company is going. Not everyone wants to sell pieces of their companies at a discount. Often you have to wait for the right environment where discounts are available and everyone else is afraid to invest. There are other tricks to getting a deal. For instance, when venture capitalists invest they do something I normally consider stupid. They try to get a deal by saying “we have to at least get our money back if the company sells”. This is called a “liquidation preference”. They might get other terms also.

Guess what? That makes their stock more expensive than common stock. BUT when the company is sold or IPOs, all the preferred stock converts to common stock anyway. Let me tell you something. The company is either going to exit for a higher price or the company is going to go out of business. Either way the preferred equals the common stock. Zero or HUGE. So once the preferred price is established by the big shot venture capitalists you can often get a discount by buying common stock. This doesn’t always work (Groupon) but it usually works if you are making sure you are getting a discount. Great in environments like right now where everyone is afraid of pulling another Groupon.

E) I have to see the exit. I have to have a general sense of how big the company can grow and what the exit can look like. I’m helped considerably by the fact that my co-investors are smarter than me and they are all looking for 10x returns on their investments. So we’ll see.

F) I keep the investment small. Never more than 1-2% of the capital I have to invest. So no one investment will destroy me.

And that’s what gets me excited about an investment.

THERE ARE NO PROPHETS ON WALL STREET

Travis Pavlik @tpavlik: your dow 40k call…whats that in “real” terms

Answer:

A couple of comments. In the past 10 years I’ve made lots of predictions based on analysis of the markets. I’ve published those in places ranging from the Wall Street Journal to Forbes to thestreet.com and probably a dozen other places. Most of them have turned out pretty good. I try not to do it too much anymore for several reasons.

A) People will always hate you no matter what. Whether you win or lose, someone lost money. And they hate you.

B) The stock market, in general, is for suckers.

C) People ALWAYS forget my good calls. The stocks that go from $1 to $30 and then get bought out. And there are plenty of those.

D) I lost interest. In general, Wall Street is crooked and I don’t like having anything to do with it. Having had everything to do with it for years. Heck, I practically applied to work for Bernie Madoff.

E) I really love the direction my writing is now going. And it’s far away from stocks.

F) I get constant hatemail about stocks. Or I see random lies about me on message boards. I really can’t stand it after ten years. You’d think I get used to people calling me an “ugly creep” but it just never gets better.

So, back to your question. I assume it is somewhat sarcastic or negative towards me for a few reasons. For one thing, I never made a prediction for Dow 40,000. I made a prediction for Dow 20,000. Second, you ask in “real” terms. I only made the prediction a year ago. So inflation’s been about 2%. If you look at housing prices (instead of rentals, which is what the inflation index is usually composed of) there’s actually been deflation. So I’m not sure what point is being made with the word “real”.

I predicted Dow 20,000 for the end of 2013. My guess is we won’t get to Dow 20,000 by the end of 2013. Growth has been slower than I thought.

Does that mean that everyone who followed my prediction was a loser and lost money. Does it make me a loser?

When I made the prediction, the Dow was at 12,470. Right now the Dow is at 13,560. So 8.7% higher. Nobody is losing money. Around the same time I also said on CNBC that AAPL was a strong buy and would be the first trillion dollar company. It was at 350 then. It’s at 700 now. About a 100% return. A few months earlier, I had also predicted that a stock, INHX, then at $1.80, would go higher. It got sold a year later at $26. About a 1400% return. Everyone who followed the advice is making money. You can’t really ask for better. There are no prophets on Wall Street.