I’m usually accused of being too much of an optimist.

When someone tells me “global warming” I immediately think, “Good thing people are working on alt-energy solutions.”

When someone tells me “automation will crush jobs” I think, “Well, look at what happened when ATMs supposedly were going to replace bank tellers. Nothing. The cost savings created a bank on every corner.”

When someone tells me I’m ugly, I think, “Ok, you’re right. But I have a sense of humor.”

If someone says, “What about American debt rising so much?”, I go through the basic math:

– The US is $19 TRILLION in debt.

– BUT the US just has to pay $225 billion a year to service that debt. That’s only 7% of GDP, down from 17% in the mid ’90s. So we’re actually financially healthier than 20 years ago.

– And if you subtract out what the US owes the US (yes, we owe money to ourselves), then the national debt is just $13 trillion and our debt obligations go down to about 3 or 4%.

If your salary was $100,000 and you had to pay just $4,000 a year to service all of your debt, you would say, “no problem”.

Let’s take on more debt.

—

(Chart: Federal interest payments are at their smallest levels vs GDP since the ’70s)

—

And yet…I think America is DOOMED. And I think there’s no solution for the country.

And people should be aware of how we are doomed so they know what to do.

There are only so many flowers you can plant over shit. Eventually the whole thing smells like shit.

Let me outline the problem that is going to bring down the United States:

A) THE GOVERNMENT BACKING OF STUDENT LOANS

This started with “The Higher Education Act of 1965”.

It has a seemingly fine and generous idea: Let’s help the less fortunate get a higher education so they can be more competitive.

I love this idea. The feeling is correct.

But unfortunately it failed due to corruption, lousy economics, lack of understanding of basic finance, and a ton of other reasons I’ll get to.

I have a solution which I’ll describe in a bit.

B) PRICE OF TUITION

Since 1965, the price of tuition has gone up HIGHER THAN INFLATION every single year (EVERY. SINGLE. YEAR) by an average of 9%.

By comparison, medical care costs have gone up faster than inflation by an average of 5% every year.

Corruption #1: Since the government is backing it, college presidents are simply charging more without thinking about the future consequences of the country OR OF THE STUDENTS who take on these loans.

—

(Chart: Inflation vs tuition. Why???)

—

C) STUDENT LOAN DEBT IS NOW $1.5 TRILLION DOLLARS

In 2003 it was $250 billion. But 9% a year faster than inflation compounds quickly and it’s not stopping.

Here’s the problem: Everyone is brainwashed into thinking they need college to 1) have a satisfying social experience from the ages of 18-22 and 2) they won’t get jobs if they don’t go to college.

So an 18 year old, whose brain is inclined toward taking more risk (as 18 year olds have been for a million years) is being offered $250,000 in loans, which they accept.

Meanwhile, they are not even allowed to drink a glass of beer.

D) THE MIDDLE CLASS IS THE VICTIM

The rich can afford to send their kids to college.

The lower class gets financial aid and has to take on less debt. OR they take on blue collar jobs, some of which pay higher than many white collar jobs (show me a poor plumber).

The middle class can only afford higher education by taking out $100,000s in student loans. Average student loan debt is about $50,000, but my guess is the middle class, which doesn’t benefit from financial aid, has a debt figure much higher.

Anecdotally, when I survey my younger friends, debt ranged from $100,000 to half a million dollars. The latter was with a doctor but, sadly, he hates being a doctor and is now trapped.

If the middle class is the victim that means eventually the middle class dies out.

—

(Chart: Declining middle class. Debt up but salaries down)

—

E) STUDENT LOAN DEBT IS THE ONLY DEBT YOU CANNOT GET RID OF IN BANKRUPTCY

Why did the government do this? Because 18 year olds are not qualified to make financial decisions about their lives.

So the government had to enforce that they can’t borrow millions and then just say, “Whoops! Bankruptcy”.

You can get rid of mortgage debt, credit card debt, any other debt with bankruptcy. But not the student loan debt you owe the government.

The government will follow you forever, garnishing your wages, until you pay them back when you are 90 years old, keeping you in near-poverty your entire life.

So much for the government trying to help kids get a higher education.

—

(Chart: Student loan debt is the largest)

—

F) ENTREPRENEURS, ARTISTS, INVENTORS, INNOVATORS WILL NOT EXIST

This current generation of young people will not be able to graduate and take risks, like being an entrepreneur, an inventor, an innovator, even an artist.

Instead, they will have to take sales jobs at eyeglass stores to start paying down that debt. The government gives six months after graduation before you have to start paying down that debt.

“Don’t take risks!”, the government is telling our kids – the exact people who will need to take risks to continue American innovation the way it’s always been throughout US history.

Why do I say “sales jobs in eyeglass stores”?

I once went to the NYU campus and interviewed about a dozen people I saw. Two of the kids had majored in economics, couldn’t get jobs, and now were unhappy working for some eyeglass store so they could pay back debt.

I know that’s only an anecdote. But they did not seem like happy, young people to me, despite their degrees.

—

(Chart: Entrepreneurship is already decreasing rapidly)

—

G) AUTOMATION

The rise in automation will force many people who work in automated industries to strike out on their own as entrepreneurs.

But since this involves risk that student loan holders can’t take, these debt holders are screwed.

The rich young people will become entrepreneurs and get richer. The student loan holders will drive Ubers for minimum wage just to keep up with basic payments.

The jobs to pay down student loan debt will disappear.

By the way, it’s not just shelf-stacking at Walmart that is getting automated.

Legal and even medical services – high end professional jobs – are being quickly automated. JP Morgan recently announced they did about 300,000 hours of billable legal work in just a weekend using AI.

This is not an anti-AI post. This is reality.

—

(Chart: Robots vs jobs)

—

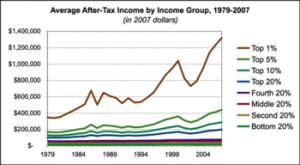

H) INCOME INEQUALITY WILL BE GREATER THAN EVER

The upper classes will continue to pay for their kids to go to Harvard. Where they will marry other Harvard grads. And then have Harvard kids.

The middle class, which is moving toward the lower class, will be forced to send their kids to lower ranked and cheaper schools (while they continue to pay down their own debt), increasing the disparity between the classes as the middle class quietly shuts down their doors.

—

(Chart: Major gaps in income)

—

I) CLASS INEQUALITY GIVES RISE TO MORE BERNIE SANDERS AND DONALD TRUMPS

I’m not saying anything good or bad about either of those two people. But their policies (as evidenced by Trump’s recent tariffs) are strikingly similar on paper.

Obama, Clinton, even Bush (Sr.), and Reagan, were centrist compared to Trump and Sanders.

I don’t care if one person makes more than another based on merit.

It’s when government policies over decades have created enough income inequality to make it impossible for a meritocracy to exist that income inequality creates a real political and cultural problem.

The entrepreneurs and artists have disappeared and we are left with just angry people making angry social media posts all day long from their air-conditioned suburban homes.

(Chart: Sanders and Trump agree on these issues among others)

—

J) AN ENTIRE GENERATION OF INNOVATION WILL DISAPPEAR, GIVING CHINA AND OTHER COUNTRIES A CHANCE TO PASS US IN EVERY TECHNOLOGY

We’re the leaders right now in biotech, alternative energy, internet tech, etc. But that’s changing more every single year.

—

(Chart: China is dominating tech)

—

K) POLITICAL MESS, ECONOMIC MESS, EVEN A CREATIVE MESS

As the classes get angrier at each other, and the political candidates get more extreme (think Germany in 1933), when will the ramifications have real costs other than angry articles in the media?

L) MONEY WILL FLEE

With chaos starting to emerge, the innovators and entrepreneurs (the ones that would normally move from middle class to upper class but will now just be upper class for generations) will start investing their money (or even move) outside of the country.

The US is the richest country because outside money from other countries comes in here because of our innovation and technology.

When money flees, America becomes dependent on the kindness of its neighbors.

How friendly are Canada, Mexico, Europe, and China going to be to our declining middle class?

—

(Chart: Global debt)

—

M) AMERICA WILL BECOME DEPENDENT ON DEBT OWED TO OTHER COUNTRIES

There will be no real leadership. No foreign allies. And what happens to countries like this? Eventual violence in the streets. German, Argentina, Russia, Arab Spring, Asia are all examples.

How long will this take?

I don’t know. 10 years? 15? But it will happen and the solutions are hard or impossible:

POSSIBLE SOLUTIONS:

Maybe there’s a way out! I’m still an optimist. At least, I think you and I can do well.

– Force tuitions to go down: This will never happen.

– Stop backing student loans: This will never happen since the basic argument is: everybody deserves a higher education. Which is untrue and a myth but people believe it strongly.

You can say, “Adjust tuition based on major”, but the reality is this will never happen.

Even Google no longer requires you to have a college degree, but I think the myth of higher education is so baked into society that it’s a hard argument to tell an 18 year old to not take out a quarter million in loans to pay for a useless degree.

– End corruption: There’s evidence states give kickbacks to companies that facilitate the college loans. Many college presidents make millions in salary. Etc.

Corruption has a tendency to get bigger, not smaller, so I don’t expect this to stop.

(John Lahey, president of Quinnipiac College, makes a $3.4 million salary)

SOLUTIONS:

The only two things I can think of are:

A) REDUCE DEMAND:

Price is always a function of supply and demand.

If you reduce the demand for college, price will be forced to go down.

And supply is already increasing. There’s a ton of online schools out there. Even many colleges offer their courses online (although without the degree).

I did a podcast once with a kid who finished an MIT Computer Science degree in a year using its online courses.

He didn’t get the degree but he got the skills.

Unfortunately, so many kids see their peers going to college and have a fear of missing out that they will insist on the standard college experience.

Meanwhile, they will have no ability to determine if the debt is a good thing for them or not. 18 year old brains are not equipped to assess risk.

So even though changing the supply / demand equation should affect tuition price, I don’t see it realistically happening.

Heck, I WROTE THE BOOK, “40 Alternatives to College” (which was #1 in Amazon under “College” for a long time) and my 19 year old still insisted on going to college.

B) SELLING FUTURE INCOME

Here’s an idea which I bet can make some money.

What if I graduate college and then say, “I will sell off 10% of all of my future earnings”.

This creates an exchange where I can invest in kids that look like they have bright futures (or some organizations can do it for charitable reasons) and then I get a piece of all the earnings of the kids I invest in.

This could be a great source of income for older people in a low-interest rate environment.

And it can also help kids monetize their future income (the way a company does every single day) to help pay down their student loan debt.

It doesn’t even have to be kids who just graduated.

Maybe when the person reaches age 30 and has demonstrated some success, people will want to invest in 10% of their future earnings.

This will help the person at age 30 pay off the remainder of their debt and move it more into the private sector.

This is exactly similar to the “Bowie Bonds” that David Bowie used in the ’90s to sell off in the present future royalties for his music.

Sure some of these “investments” will not work out but some will, creating a source of income for older generations and removing the debt of younger generations, allowing them to be the entrepreneurs and innovators they were meant to be.

Will this happen? I don’t know.

Why don’t you make this business? Be a billionaire.

TL;DR

The corruption of the college tuition system has ruined the country.

This generation of kids will not be able to be entrepreneurs or innovators, which has been the driving force of US growth throughout its history.

This will lead to the death of the middle class, further income inequality, and eventual recession, depression, and violence.

There are solutions, but they are unlikely to be implemented.

SO… the best way is for people to find opportunities right now before the s**t hits the fan (even though it’s already starting to hit the fan). There are still plenty of opportunities.

And, if I were 18, I’d start making money right now instead of spending an enormous amount on a wasted four year social experience.

And, yeah, I’m still an optimist.

I want to be in love, have more kids, take care of myself, and die a peaceful death with high quality of life until old age.

I want to choose my future.