Last week I visited Google, Facebook, and LinkedIn. I visited Google because I wanted to see the future.

Specifically, I knew Astro Teller, who runs Google[x], the division behind the driverless cars, the cancer magnet, and a ton of other things that offer an interesting glimpse into the future. Astro told me he was trying to solve “billion person” problems.

Example: the “cancer magnet” they are working on. You put it around your wrist and it attracts all the cancer cells in your body to your wrist so that they are then easier to remove.

Or the driverless cars. Somehow Claudia, my wife, got in the garage where they were making the cars. She was DEFINITELY not supposed to be there.

I think it’s really sexist that they let her in there. For instance, if I were wearing a pretty, low-cut, white dress, they probably would not let ME in there.

Then she started taking pictures and they kicked her out.

(inside the garage where they were testing the latest version of the driverless car, right before they kicked Claudia out)

Then we had coffee with Astro.

Which has sort of been a bucket list item for me since I was a kid: to at some point say the sentence: “Then we had coffee with Astro.” Even though when I was a kid I didn’t know anyone named “Astro”.

He told us some other stuff they are working on. It honestly blows my mind. While many people go on CNBC and spew nonsense while spitting out of their filthy teeth and spouting macroeconomic garbage, Astro was explaining to us how he was trying to solve “billion-person” problems.

By the way, I need to go to the dentist also. But the last time I went to the dentist I ended up on Jay Leno in a rather convoluted story I can’t get into.

At Facebook, I got a glimpse into what the future of the user experience of the largest social network. With 1.4 billion users, if Facebook was a country it would be the second largest country in the world. So the people in charge of the user experience there have quite a bit of influence on how the world gets its media. I honestly think somewhere in this mix lies the future of all society one way or the other. There can’t be this much influence for too long before something happens – good or bad but I’m an optimist and I think good.

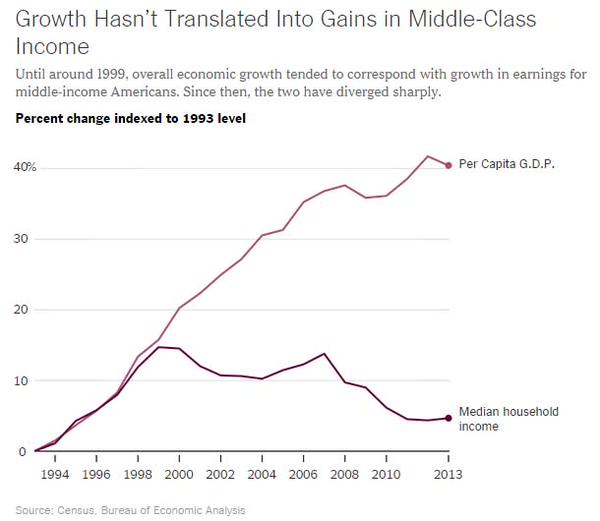

And at LinkedIn, I met with about a dozen “influencers” to try and figure out how LinkedIn can better help job seekers. The crazy thing about the economy is that even though GDP is higher than ever, income vs inflation is at an all-time low relative to the strength in the economy.

So what’s going on? Clearly there is enormous opportunity and optimism for the future. But the maze of navigating that opportunity has become increasingly difficult.

The newspapers won’t tell you how to do it. The Wall Street Journal won’t tell you how to do it. In fact, if you follow their front page headlines you will be more lost than ever. They thrive on negative news that has nothing to do with the current economy. I used to write for the WSJ and the Financial Times when I was running my fund of hedge funds. Ultimately, I didn’t want to write about useless news that had no bearing on whether or not you and I can live a better life.

The newspaper knows a basic evolutionary fact: your ancestors ran from lions when they had a choice between going to the apple tree on their left or run from the lions on their right. The people who died out went for the apples.

If you are a soldier in the Ukraine this newsletter totally doesn’t apply to you, for instance. Even though it’s on the front page of the Wall Street Journal.

Except for this one line I will write: stop being a soldier in Ukraine. This is critical advice you should take. And I don’t really like to give advice. Now you should put down the newsletter and figure out how to stop guarding the border.

In general, I don’t like to be informed. When I read the Wall St Journal it’s all about places that have nothing to do with me: like Ukraine, or obscure parts of China, or “trade wars” or some merger that is never going to work out.

I’ve been involved in many mergers. Sadly, most do not work out. Here’s one that will work out: Disney buying Lucasfilm. That’s a great acquisition. Google buying Android was good. Most other ones don’t work but they all make the newspaper.

So instead of spending a half hour reading the newspaper (no offense to everyone in Greece but I don’t care about your debt and you probably shouldn’t either) I read a good book. That’s 180 hours extra hours a year I get to read a good book.

Warren Buffett has said that he’s wasted 10% of his life because he can’t read fast enough. I was talking to memory expert Jim Kwik. He gave me some advice: reading is visual, he said. And the eyes are not used to seeing these squiggly marks on a page. We didn’t really evolve that way.

Speed reading technique:

So we can read faster if we use a finger to go along with our reading. “The body moves the brain,” he said, “not always the other way around.” Then it’s easier for our eyes to follow. It turns out people read 10% faster that way. To make it even more quick, use your left finger, Jim Kwik says. Because then it engages the right side of your brain. I always get confused which side is which but I’ll take his word for it.

I tried it. So far, so good. Reading faster could be the most important activity of your life. A good book is the curated thoughts, usually, of someone very smart. It’s like a virtual mentor. If I can get more virtual mentors in my life I will have a more fulfilled life.

If I spend an extra 180 hours reading good books now I can either read 20% more good books or I can save myself 36 hours to do other things, like follow people in the street until they notice me and I look away awkwardly. I’ve been trying this tip plus others Jim gave me and they work really well.

But what about economics? The Wall Street Journal, which I used to write for, has a lot of things about economics. Shouldn’t we read about that?

No.

I hope I set your mind at ease in a second. But all of economics is wrong.

Here’s the facts: Physics, chemistry, and biology are all hard sciences. They ask serious questions and sometimes come up with legitimate answers. The combination of all of those sciences has led to greater understanding of health, less infant mortality, longer lifespans, nuclear weapons, robots, and so on.

Anthropology, Sociology, and Psychology are known as the soft sciences. They’ve led to Darwin coming up with a theory of evolution. They’ve led to interesting results on positive psychology and what elements are most important for “well-being” in life (competence, good relationships, and autonomy). And occasionally they keep couples married longer than they should be (a bad side effect of psychologists being the only doctors who NEED to never cure their patients).

But what is Economics? Is it a hard science or a soft science?

It’s neither. Economics is about as scientific as astrology. It’s all wrong or, at best, guesswork.

Above I gave a technique that has already changed my life for the better and I hope it will change yours. I like sciences that make my life better and ideas that are easy to test so I can believe them.

So please forgive me if you don’t believe what I’m about to say about economics. I know everyone who gets this newsletter is smart and many of you have spent time in business and the finance world.

But let me do a basic review of economics.

First, let’s start with the absolute basics and why they are wrong.

Basic Idea #1: Price is a factor of Supply and Demand.

This is simply not true. The price of oil, for instance, changes every day. But demand and supply might not change. Even the perception of demand and supply dating years out might not change. But governments manipulate price and even companies manipulate price. A simple example: if Elon Musk says he is working on a new battery plant, then the price of oil might go down.

Even if he hasn’t started the plant. Even if he has no new innovations in batteries. Even if he says maybe it will take ten years to finish the plant. Oil still might go down that day EVEN IF supply goes down and demand goes up.

In some cases Price is a factor of Supply and Demand and in some cases it isn’t. So…guesswork.

Basic Idea #2: Opportunity Cost. Opportunity cost is sometimes a psychological problem. Like, “if I had just taken that job at Google instead of the job at the Lumber Warehouse, then I would be rich now”. Because of opportunity cost.

Here’s the problem: it’s hard enough to predict the future. Now you want me to predict something happening in an ALTERNATE REALITY. I’m not smart enough for that.

So opportunity cost is science fiction. It’s like the Matrix.

And yet, those are the two aspects of economics closest to reality. Everything else is complete fiction.

Interest rates, for instance, have nothing to do with the economy. I don’t care how many studies show one thing. There are just as many studies showing the other thing.

Inflation is a myth. Supposedly we’ve had mostly inflation for the past 100 years. This is completely false. A $200,000 computer from 20 years ago is now in my pocket for $400. Some things cost more and some cost less.

So is inflation bad or good? Is deflation bad or good? Hyperinflation seems bad. When you have to carry wheelbarrows of trillion dollar bills to buy a loaf of bread like in German in the 20s.

But that’s not inflation. That’s War + Reparations + millions of people dead so innovation comes to a halt. If you are in a country with those situations you should try to leave.

What about deflation? When people don’t want anything anymore, prices go down. Well, to be honest, maybe people shouldn’t want Coca-Cola anymore since it’s basically the same as any other generic soft drink. It’s just the 2500 advertising images every day that boosts prices up to brainwash us into wanting things that normally we wouldn’t want.

If you get rid of all advertising there will suddenly be massive deflation because we won’t pay extra for shirts made in India for 50 cents but sold here for $195. Is this bad or good? I don’t know.

This is why I don’t read the newspaper.

What about gold? Everyone says that paper dollars are “fiat currency” because it’s arbitrary what they are worth whereas gold is real value. Let me tell you something: gold is a rock. It’s a rock that is also a fiat currency.

I was once on The Kudlow Report on CNBC. My kids were watching. This was in 2011. I was saying the markets were going to all time highs, Don Luskin said that gold was going to go to all time highs. I explained my rationale to Don.

He shook his head and said, “James, James, James…” Now, for the rest of my life, whenever I say anything to my 13 year old she shakes her head and says, “James, James, James.”

I wrote Don the other day to see how he was doing. I asked him if he needed any gold fillings because I know a dentist who will do it cheap. He didn’t respond.

Why did I think the market would go to all time highs? Because for the past 200 years that’s all it’s done. That doesn’t mean most companies are good. In fact, most companies fail. But then they get replaced by newer companies and the market as a whole keeps going up.

When will the markets permanently go down? When there are no more good companies that are starting. When we all just decide to watch TV and stop innovating. The latest horror story by pundits is that this scenario will actually happen because robots will replace all of us and, presumably, feed us our soft drinks while we watch TV.

I have one answer to that.

Manure.

In the 1890s, horses dropped 4.5 MILLION pounds on manure on the streets of New York City EVERY DAY.

You can imagine what the newspaper pundits said. I will tell you:

“By 1950, New York City won’t exist, it will be one big pile of manure.”

This was a serious environmental issue. They were sketching out plans for huge shovels and people to man the shovels and big troughs to put the manure. Meanwhile, the population of NYC was expanding so more jobs were created for horse carriage drivers, horse carriage makers, parts makers and so on.

And then something happened.

Cars.

Did everyone lose their jobs? Did the entire future change? Did all the planned jobs evaporate? Yes.

And something totally unpredictable happened. Innovation enhanced productivity, which created even millions of more jobs that could not possibly have been planned beforehand. Not a single person could have planned the 100 year boom that was basically kicked off by two things: enhancements in transportation, and the invention of air conditioning (which allowed mass migration of industry to the South).

So we can’t predict. But it seems through the course of history that innovation is a good thing.

I prefer history to a made up science like economics because we can actually see what happened when seismic shifts in technology occurred.

3000 years ago we were writing down all of our information on ….tablets. Now, we write down and consume all our information on…tablets. That’s how history works.

Some of the things I saw being worked on at Google and Facebook were so remarkable as to defy belief. But they were all things that solve billion person problems. This creates industry, creates jobs, alleviates suffering and misery. I’m looking forward to the future and I hope you are also.

What about interest rates? Isn’t that economics?

No. Interest rates don’t mean anything. Never once has interest rates predicted the direction of any market except by luck. Nor have they really even effected interest rates in other markets. For instance, T-bills are about 0% but our youngest debtors (students) are being stuck with 6% interest rates they have to pay for the rest of their life.

A young nurse wrote me recently. She graduated a top school, then graduate school. She’s now a nurse with $210,000 in debt at 7.6%. Guess what? Like almost everyone else in the world at some point in their lives, she would like to have the chance to switch careers. She can’t because of her debt. I feel bad for her.

Two things to remember:

– the average person will switch careers (not just jobs but entire careers) 14 times in their work life.

– the average multi-millionaire will make money from at least seven different sources of income simultaneously. More on this in the next newsletter.

The student debt situation is at the bursting point. It will change. About ten years ago, not going to college would have been unthinkable. In 2005 I wrote in a column in The Financial Times that perhaps children should consider alternatives. I got an immediate death threat. I tracked the death threat down to an IP address at Brown University and found out who it was. I called the head of internal police at Brown. His response: Oh yeah, that guy threatened a librarian also. But listen, he’s about to graduate. Do you really want to press charges or anything?

But anyway…

Now, at least, it’s conversation. Is college bad? I don’t know. But I do know the debt is bad enough that I’m glad there are alternatives: Coursera, lynda.com, Udemy, Khan Academy, and the many colleges that are putting their courses online for free.

People want to hire other people with skills, not pieces of paper. Eventually this will change the education landscape.

The newspaper has lots of charts, and figures, and numbers and percentages and graphics. None of them will mean anything.

One of the most important things for brain health is stress management. The newspaper is designed to be stressful. They know this. For every one thing that causes stress you need five positive things to counteract it to have the same balance of “happy chemicals” in your brain (oxytocin, serotonin, dopamine, and endorphins). Otherwise you stay glued to the negative and keep coming back for more.

By the way, according to Jim Kwik, here are the TEN most important things for brain health: (as Jim Kwik put it, practice every day of these ten things will turn your brain into a superpower).

A) Diet: and by “diet” here’s what I recommend: be a flexetarian. No one diet is the answer. For every macronutrient you remove from your diet (meat, carbs, etc) there is some incredibly healthy population out there that thrives on that macronutrient. To me, a healthy diet simply means no excess and no snacks.

Jim Buettner, who wrote the Blue Zone Solution told me that if you just switch from 15 inch plates to 10 inch plates, studies show that people eat 20-30% less calories. Claudia went a little overboard. She threw out all our 15 inch plates and bought EIGHT inch plates. Now I’m starving.

B) Killing Negative Thoughts. In other words, if you tell yourself you “can’t” then your mind is going to believe you and it acts as a sort of hypnosis. Example: if you say, “I’m bad at remembering names” then you will forget the name of the next person you meet. Another important note related to this: the most important aspect of charisma is remembering people’s names.

C) Brain supplements. Sometimes the right food is not enough. So make sure you have a lot of vitamin B in your diet.

D) Exercise: this doesn’t mean going to the gym every day. But walking, doing light exercise, anything that keeps you moving for awhile. As Jim told me, “when the body moves, the brain grooves”

E) Positive Peer Group: you are the average of the five people you spend the most time with.

F) Clean Environment: I have detailed notes on this for my book club members but basically the cleaner your house and office and desk are, the less stress you have, the more energy your brain has for other things. Don’t forget that the brain is just 2% of your mass but consumes 25% of your oxygen and the nutrients you consume that day. So the less stress, the less energy the brain needs to do the things that are important to you.

G) Brain protection: wear a helmet. Jim Kwik had a traumatic brain injury at five which gave him severe learning problems. This is what gave him his life long focus on improving and understand his brain function so now he coaches everyone from Richard Branson to world famous actors, CEOs, etc.

H) New learning. The brain thrives on novelty. New research shows that even into old age the brain can still grow new neurons and form new strong connections. If you never learned tango, maybe give it a try. If you never learned to watercolor, maybe give it a try. Anything new.

I) Sleep. The brain rejuvenates itself during sleep. It’s still just as active, forming new connections, etc. but it’s not bogged down by the energy draining that occurs when you are awake.

J) the aforementioned Stress Management.

We are entering a terrific and terrifying new economy, with innovations in energy, healthcare, biotech, tech, and all the gatekeepers are being put to sleep one by one. To be able to meet the challenges coming it’s important to be at optimal strength in brain and health. I can’t say I am always at optimal strength but I think the key is to improve a little bit every day.

Improvement compounds and is not linear. 1% a day leads to massive improvement in a year, in two years, in five.

Ok.

Once again, I don’t really like to recommend stocks but the stocks I do like to look at (and I personally invest in) are ones that I think are going up not because of charts or short-term BS but because I think they are led by strong leaders and are making improvements that can help the world. Last month was Trovagene, which does a “liquid biopsy” through urine to determine if you have a range of cancers and other diseases.

When I recommend a stock it usually means I own it and I plan on holding it forever. That’s the case with Trovagene. We know prevention is the cure. We also know healthcare is a mess. So I’m always in favor of prevention.

This month, I have to ask you: the stock is not a secret and it’s a well known company. But PLEASE, don’t tell anyone else the reasons I like this stock. It’s not just a way to make money, it’s a way to have a better lifestyle if you are a frequent traveler.

This month I want to talk a little bit about JetBlue, the airline, because quietly they have been making changes that they have barely been announcing that are BLOWING AWAY every other airline and the stock, while up significantly, is barely making a dent against the stocks of the other airlines.

In fact, I’m writing this right now while I’m on JetBlue. All of their cross country planes have free WiFi. Maybe all of their planes do. I don’t know. But that’s not the special part.

Recently, JetBlue has started rolling out their “Mint” class. Imagine First Class on American Airlines, but better and cheaper.

I have a “suite” to myself and I can close the door. And I have a flat bed. Some first class seats on other airlines have flat beds but some don’t. ALL JetBlue Mint seats have flat beds. The suite I’m in now is equivalent in size to the business class seats on Emirates which cost $30,000.

Cost of a Mint seat roundtrip to LAX from JFK: $1100

Cost of a First Class American Airlines seat round trip from JFK-LAX – $3200 (even with no flat bed).

So for 1/3 of the price I can go on the same route and get a better seat.

Quietly, JetBlue is rolling out Mint to all of their routes. This reminds me of when Starbucks was going from regional to national to international and the stock went up in a straight line. JetBlue Mint is basically like Starbucks. It started off with the main routes (JFK-LAX, JFK-SFO) and is expanding to every route.

What will the passengers of the other airlines do? Simple. They will switch. And it will take the other airlines years to catch up, if at all (it’s not that easy to cut airfares by 2/3 and still make a profit while retrofitting your airplanes to have bigger seats with flat beds).

The next routes to be added: JFK – Aruba and JFK – Barbados right in time for the Christmas season.

I’ll get to financials in a second. Let me tell you other reasons why I like JetBlue.

1) CUBA. JetBlue is going to be the first airline to fly to Cuba now that relations have thawed. It’s more than just liking the fact that they have a new route. They saw an opportunity and they jumped on it. I like leadership that does this. Why didn’t any other airline do this?

2) HOTEL. JetBlue is taking the old abandoned TWA terminal at JFK and transforming it into a hotel with 500 rooms. I don’t even care if they make a profit on the hotel (they will). 13 million people fly in and out of JFK each year and every single one of them will see the giant JetBlue sign on that terminal. How much in free advertising dollars is that worth?

3) NEW REVENUES: Yes, sadly, JetBlue is going to start charging for the first bag of checked luggage. $40.

BUT, every airline in the country does this except for Southwest. AND, this $40 charge should add about $300,000,000 in revenues with almost 100% margins to the bottom line.

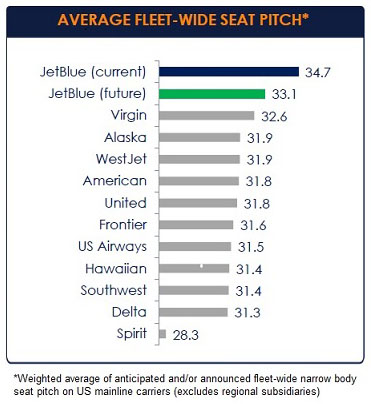

4) MORE SEATS. JetBlue is going to add 15 more coach seats per flight.

How will they do this? By making the seats smaller. Ugh! But wait. Let’s compare the new small seat width with the seat width and legroom of every other airline. My researchers came up with this chart:

So they will still have the biggest seats in the entire industry and add more profits to the bottom line.

5) HEDGING THE RISK OF OIL GOING BACK UP.

When oil prices are high, airlines make less money. So when prices are low, some airlines try to catch the bottom by doing something called “hedging” which allows them to pay the low price even if oil goes back up.

Unfortunately, many airlines did this way too early (Delta and Southwest lost hundreds of millions on this tactic) and it cost them a lot of money as oil went even lower.

Guess what. JetBlue didn’t hedge at all. So over the next few quarters should see substantially higher margins than the majority of the airlines that did hedge.

—

I wish I could say JetBlue is dirt cheap like I did with Trovagene. I do think it’s a buy here but it could just as easily pull back. I’m an owner and I plan on owning it forever.

It’s at 20 now and if there is any volatility in the market I could see it pulling back to 15. But if it does and you buy there (or even here although you might experience that volatility), in the long run you’re going to see a straight up move similar to Starbucks as they start adding Mint routes to every destination in the country, and start rolling out these new changes that will go directly to the bottom line.

Also, if it is still at $20 six months from now, then I do think it’s a strong buy.

In the meantime, fly a better-than first class life at 1/3 the price as they start rolling out more routes for their Mint class. Everything is going well for this airline. The market has started to recognize that and the stock has been going up over the past year. I expect it to continue to go up but I’m very conservative and would prefer the price to be a bit lower.

Oh, I do want to tell you about another stock. I know I keep saying this is not an investment newsletter. But remember two months ago when I was explaining “closed end funds” that were good trades. Here’s another one that was suggested to me by a high up analyst at a billion dollar hedge fund and then I did my own deep dive on it.

I originally put this idea in a sample of a newsletter I’m thinking of putting together that will be more investment focused. It will be based on the best ideas I get from the hedge funds that I used to work with.

Here’s the idea:

Royce Micro-Cap Trust (RMT) is a high quality closed-end fund.

A closed-end fund is basically a mutual fund that trades on the various stock exchanges. Because it’s price is determined by how it trades it often trades lower than the amount of assets it holds.

If I say, “XYZ fund is trading 10% below it’s “net asset value” (NAV) that’s like buying a $100 bill for $90.

Most closed-end funds trade below their NAV. The trick is to buy them when they are irrationally trading lower than their normal discount to NAV. If you understand their history and the WHY of their current price, you can find very safe opportunities (i.e. it’s ALWAYS safe to buy a $100 bill for $90 if you make sure the $100 is not counterfeit).

Royce is a well known mutual fund family. Well known because they keep their assets under management tiny relative to the big mutual fund families and they have a strong history of positive returns in up and down markets due to their value investing style. Charles Royce has been running the company for 40 years and is often mentioned alongside Warren Buffett as among the best investors in history.

So when a hedge fund mentioned to me it was trading for “90 cents on the dollar” and they were loading up, I had to take a deeper look.

As early as last December, it was only trading at 4% discount to NAV. So even if none of the stocks they own move, there is potential for a 7% gain. Right now it’s near the lowest discount to it’s net asset value in almost two years.

The current dividend is 9.7%, only 10%. So again, if the underlying stocks don’t move, there is the potential for a 7% gain due to the discount, plus another 10% annual gain due to the dividend.

Why did it trade this low compared to what it has in the bank?

“The market has been selling off microcaps lately. So all microcap funds have traded down. But here’s the catch, almost 50% of RMT is simply in cash and safe bonds. So you really are buying 90% on the dollar on at least half the fund. The other half the fund is high quality companies.”

For instance, one of their top holdings is Atrion (ATRI), a $650 million market cap company (not a microcap) that has $20 mm in cash, no debt, and trades for just 12 times cash flow.

Their top equity holding is Integrated Electric Services (IESC) which has $37 million in net cash, trades for just nine times cash flow, had a $2,000,000 insider PURCHASE by one of its largest shareholders a year ago, and Renaissance Technologies, the most successful hedge fund in history, is a large shareholder.

So you get to buy these companies and the other companies in their portfolio at a discount while you collect the dividend and wait for the discount to net asset value to close.

Meanwhile, the average five year return of RMT over the past five years of the stock in it’s portfolio is 15.23%.

When you can buy $100 for $90, and understand why it’s there, and can dig down on the stocks in the closed-end fund’s portfolio, AND get a dividend while you wait, it’s probably a safe and lucrative buy.

If you like this idea you might like the investment newsletter I’m probably going to put together later this year.

—

Next month (or the month after)…I have a special report coming out on 100 jobs one can do from home. I also plan on eventually telling the story of the smartest executive I’ve ever had a meeting with. Additionally, doing another deep dive on a stock that is severely undervalued.

And in the meantime, I hope you break a world record with me for the Guiness Book of World Records.

AJ Jacobs, author of many bestselling books is putting together the World’s Largest Family Reunion on June 6 in NYC. The prior record is approximately 4000 “cousins” at one family reunion. Guess where it was? West Virgina. This one is in NYC.

AJ has been very systematic in discovering who his cousins are and through partnerships with various genealogy sites has basically determined that he is directly related to about 277 million people.

Sister Sledge will be there, singing, “We Are Family”. I will be speaking there. Our cousin, Dr. Oz, will be speaking there. Our other cousin, David Blaine, will be performing. And many more things will happen. But I hope you come to my talk there in the afternoon.

Here is a special discount: https://www.eventbrite.com/e/global-family-reunion-festival-tickets-15739970676?discount=SPEAKER

for subscribers to this newsletter. Let’s break a Guiness Book of World Records record together.