Elon's Big $123 Billion Valuation Problem

Not all profits are created equal.

What I mean is if both an AI company and a traditional auto manufacturer earn $1 million in profit, the AI company will likely be valued higher by investors.

That’s because the future growth of the AI company is likely higher than the auto manufacturer.

In other words, the AI company will trade at a higher “multiple.”

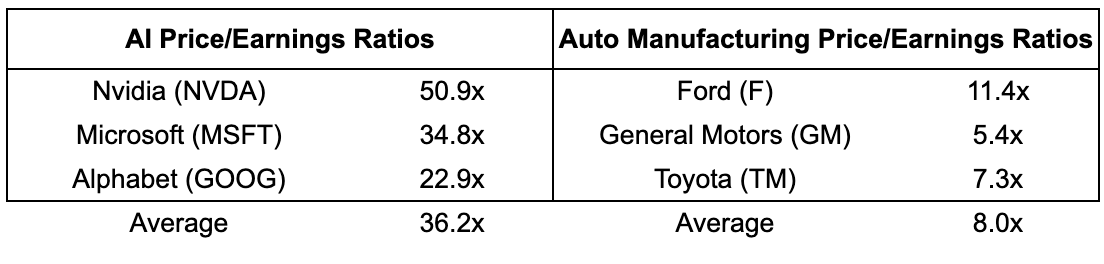

Here’s the price/earnings (PE) multiples of some AI and auto manufacturing stocks:

AI companies are valued at an average of 36x earnings whereas auto manufacturing stocks are valued at an average of 8x earnings.

If both an auto manufacturer and an AI company earn $1 million in profit, the auto manufacturer will be valued around $8 million while the AI company will be valued around $36 million.

This is “back of the napkin” valuation 101.

I bring this up because this morning, Tesla announced full self-driving would soon be available in Europe and China.

The stock shot up as high as 7% on the news.

Elon Musk has been very vocal recently about why he thinks Tesla’s stock shouldn’t trade like a traditional auto manufacturer.

From the valuation 101 lesson above you can probably understand why.

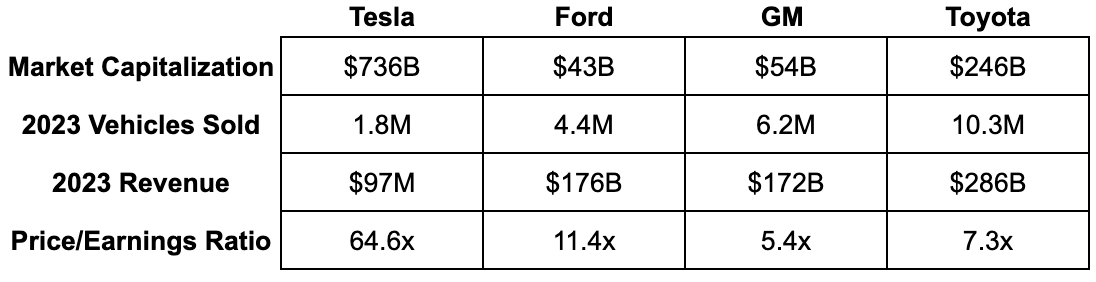

Tesla earned $15 billion in profit last year. If it were valued like a traditional automaker, Tesla’s valuation would be somewhere around $120 billion. ($15B multiplied by an 8x multiple)

That would be well below the company’s current $736 billion valuation.

So why is Tesla’s market cap approximately 15x the size of Ford and GM, and 3x the size of Toyota, despite Tesla selling just a fraction of the cars compared to these companies in 2023?

You guessed it. Investors are expecting big innovations out of Tesla in the AI, autonomous driving, and robotics departments.

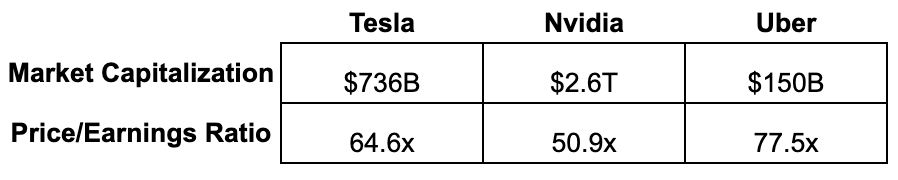

So, much to Elon’s delight, the company trades more in line with companies like Nvidia and Uber versus traditional auto manufacturers like Ford, GM, and Toyota.

This morning, when Tesla announced full self-driving would soon be available in Europe and China, investors were reminded of the company’s impressive technology and sent shares higher by 7%.

[Contrast this to a few weeks ago when Tesla delayed its planned robotaxi event. The stock immediately dropped 9% as investors repriced the stock to trade more in line with traditional automakers.]

You can see why Elon is so vocal about Tesla being more of an AI company versus a traditional automaker.

The man owns 20% of Tesla.

At Tesla’s current valuation his stake is worth $147 billion.

If Tesla traded at 8x earnings, like traditional auto manufacturers, that stake would plummet to $24 billion - a $123 billion difference!

Thankfully, news stories like the one earlier today help his cause.

To find out whether the stock can continue to trade this high, all eyes are on the company’s robotaxi event on October 10th.

As always, we’ll bring you the coverage straight to your inbox.